Introduction: Filing an insurance claim can seem like a daunting process, but it’s crucial for protecting your financial security after an unexpected event. An insurance claim is a formal request to your insurance provider for coverage or reimbursement based on the terms of your policy. This comprehensive guide will walk you through the insurance claim process in the United States, ensuring you’re well-informed and prepared to navigate it smoothly.

Types of Insurance Claims: There are several common types of insurance claims, each with its own specific requirements and procedures:

- Health Insurance Claims: Filed for reimbursement of medical expenses covered under your health insurance policy.

- Auto Insurance Claims: Initiated after a car accident or other vehicle-related incidents to cover repair costs or liability.

- Homeowners Insurance Claims: Submitted for damages to your home or personal property due to events like fire, theft, or natural disasters.

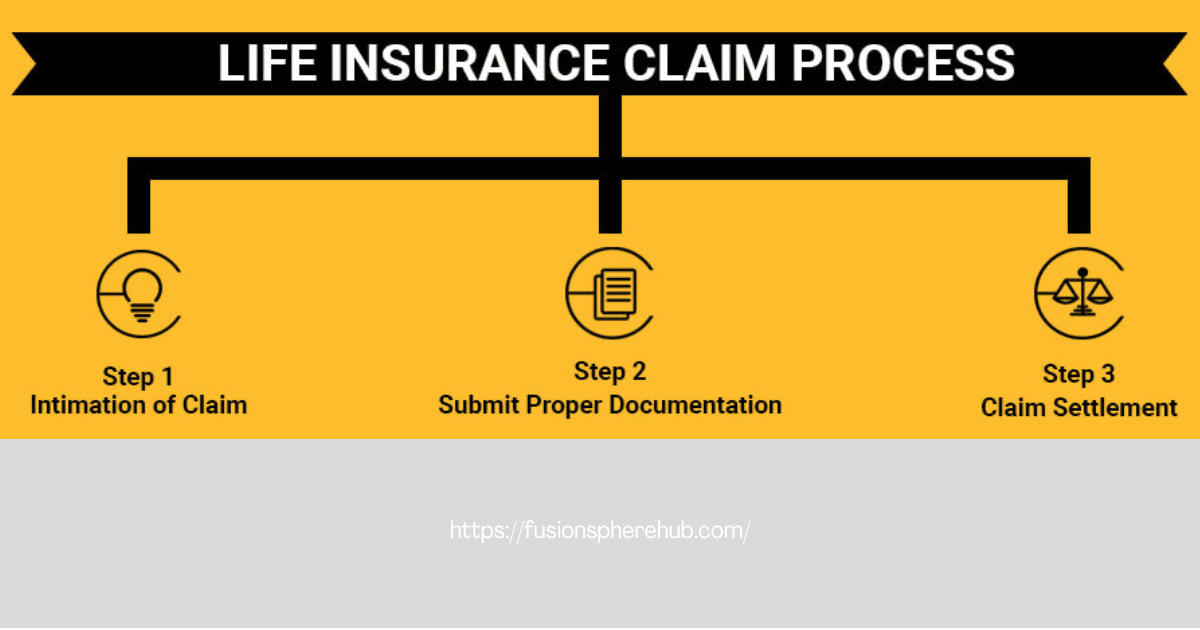

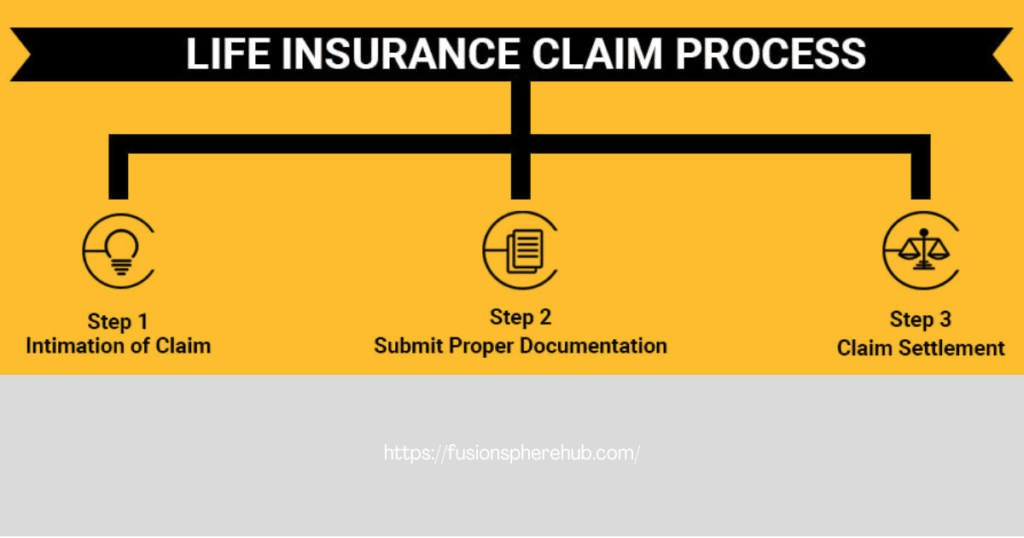

- Life Insurance Claims: Made by beneficiaries to receive the death benefit after the policyholder’s passing.

The General Claim Process: While the specifics may vary depending on the type of insurance and your provider, most claims follow a similar general process:

- Reporting the Incident: Promptly notify your insurance company about the event or incident that requires a claim. Many insurers have time limits for reporting, so act quickly.

- Gathering Documentation: Collect all relevant documentation, such as police reports, medical bills, repair estimates, or death certificates, to support your claim.

- Filing the Claim Form: Complete and submit the claim form provided by your insurance company, including detailed information about the incident and any supporting documentation.

- Adjuster Assessment: Your insurance provider will assign a claims adjuster to investigate and assess the validity and value of your claim.

- Claim Settlement or Denial: Based on the adjuster’s findings, your insurance company will either approve and settle the claim (paying out the covered amount) or deny the claim if it is deemed invalid or not covered under your policy.

Health Insurance Claims: When filing a health insurance claim, you’ll typically need to provide the following documentation:

- Medical bills and receipts

- Explanation of Benefits (EOB) from your insurance provider

- Medical records or doctor’s notes related to the treatment

Most health insurance claims must be filed within a specific timeframe, usually between 60 and 120 days after receiving treatment. Be sure to check your policy for the exact time limit.

Auto Insurance Claims: For auto insurance claims, you’ll need to provide:

- Police report (if applicable)

- Photos or videos of the damage

- Repair estimates from auto body shops

- Rental car receipts (if a rental was necessary)

It’s essential to report auto accidents promptly, typically within 24-48 hours, to avoid any delays or complications with your claim.

Homeowners Insurance Claims: When filing a homeowners insurance claim, be prepared to provide:

- Photos or videos of the damage

- Receipts or proof of ownership for damaged or stolen items

- Repair estimates from contractors or professionals

Most homeowners insurance policies require claims to be filed within a reasonable time frame, usually between 30 and 180 days after the incident.

Life Insurance Claims: To file a life insurance claim, the beneficiary(ies) will need to submit:

- A certified copy of the death certificate

- The life insurance policy documentation

- Proof of their relationship to the deceased policyholder

Life insurance claims are typically filed by the beneficiary after the policyholder’s passing, and the process can take several weeks or months to complete.

Tips for a Smooth Claim Process:

- Take photos or videos of the damage or incident as soon as possible to document the evidence.

- Maintain detailed records of all communication, documents, and expenses related to the claim.

- Open communication with your insurance provider requires honesty and clear information.

- Ask questions and clarify any doubts you may have about the process or your policy coverage.

- File claims promptly to avoid any potential delays or complications.

Disclaimer: The information here is for informational purposes only and doesn’t constitute legal counsel. Insurance claim processes and requirements may vary by state and insurance provider, so it’s always advisable to consult with your insurance company or a legal professional for specific guidance.

Conclusion: Understanding the insurance claim process is crucial for ensuring you receive the coverage and reimbursement you’re entitled to under your policy. By following the steps outlined in this guide and being proactive throughout the process, you can increase your chances of a successful and hassle-free claim experience. Remember, your insurance provider is there to protect you, and filing an insurance claim is a legitimate exercise of your policyholder rights.

If you’re considering enrolling in an insurance plan or need guidance on navigating the insurance claim process, check out our Insurance category.